Bank Owned Life Insurance Accounting

Understanding its impact on the financial statements of your business is an important element in making a decision on the use of a business owned life insurance policy. Sophisticated financial institutions are using boli to:

Implementing Accrual Accounting In The Public Sector In Technical Notes And Manuals Volume 2016 Issue 006 2016

Bank owned life insurance (boli) bank owned life insurance (boli) is defined as a company owned insurance policy on one or more of its key employees that will informally fund the financing of employee benefits programs.

Bank owned life insurance accounting. Bank owned life insurance (boli) is a tax efficient method that offsets employee benefit costs. However, with respect to this. A life insurance policy you can buy to insure the lives of your key employees.

Term life insurance offers peace of mind. Life insurance premium expense account: $5,000 life insurance income account:

The ability of state chartered banks to purchase life insurance is governed by state law. Term life insurance that will give you peace of mind. Bank owned life insurance (boli) uses tax advantages to create an efficient way to offset employee benefit costs for banks and credit unions.

Only the amount that could be realized under the insurance contract as of the balance sheet date (i.e., the cash surrender value reported to the institution by the insurance carrier less any applicable surrender charges not reflected by the insurance carrier in the reported cash surrender value) is reported as an. Banks use it as a tax shelter and to fund employee benefits. This, of course, is done within the context of a legitimate business reason for a bank owning life insurance.

While any insurance owned by a bank can be referred to as boli, the term is most often applied to insurance marketing programs in which life insurance is offered to a bank specifically as an opportunity for the bank to take advantage of tax deferred cash value growth. The policy account will be debited by the amount. The safe and sound use of boli depends on effective senior management and board oversight.

Pricing is another critical factor, because it is much more dynamic than might be the case for retail products. As an asset on the bank’s It can help banks deliver on benefit promises made to employees and enable them to provide more competitive benefit programs while containing costs.

Term life insurance offers peace of mind. For this purpose, it is better to provide an amount equal to the difference between the surrender value of the policy and the amount of debt so due out of profits and transfer the debtors’ balance to a policy account. The code states that the entity should record the amount that it

These are types of life insurance policies taken out by a company (or a bank) on the lives of key employees. Term life insurance that will give you peace of mind. The bank purchases and owns an insurance policy on an executive’s life and is the beneficiary.

The cash surrender value of those policies totals $182.2 billion. A bank will purchase and own a life insurance policy on an executive or group of executive’s lives and the bank is listed as the beneficiary of the policy. Boli — an investment or life insurance?

Ad are you worried about your future? The cash surrender values of boli were $21.4 million and $21.7 million as of december 31, 2011 and 2010, respectively. Boli has its roots in corporate owned life insurance, which has been used by large corporations for decades to offset employee benefit plan costs and other liabilities.

$3,200 conclusion the use of life insurance may be a key financial decision for your business. The company (or bank) pays the premium on the insurance, but is also the policy beneficiary. Ad are you worried about your future?

At purchase, a stated maturity value is known, which over time may increase.

Understanding Sipc And Fdic Coverage Ameriprise Financial

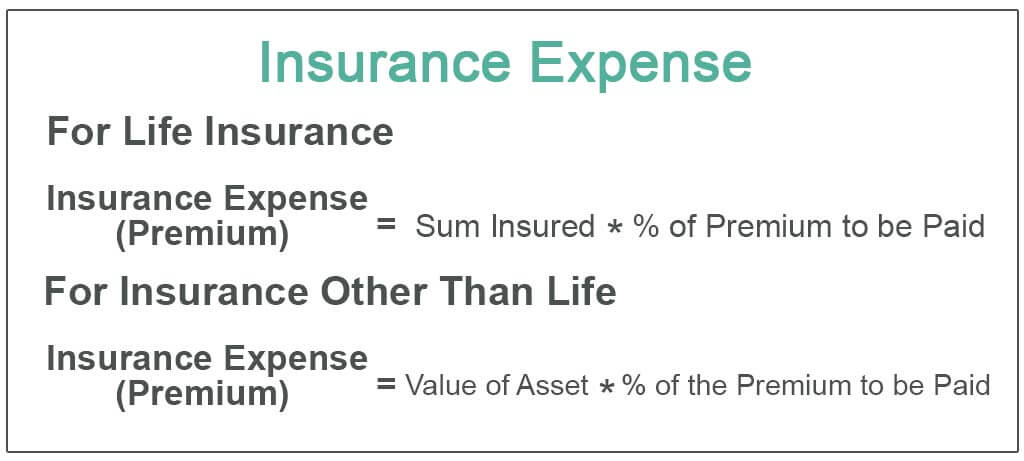

Insurance Expense Formula Examples Calculate Insurance Expense

Here Are The Benefits Of Bank-owned Life Insurance Independent Banker

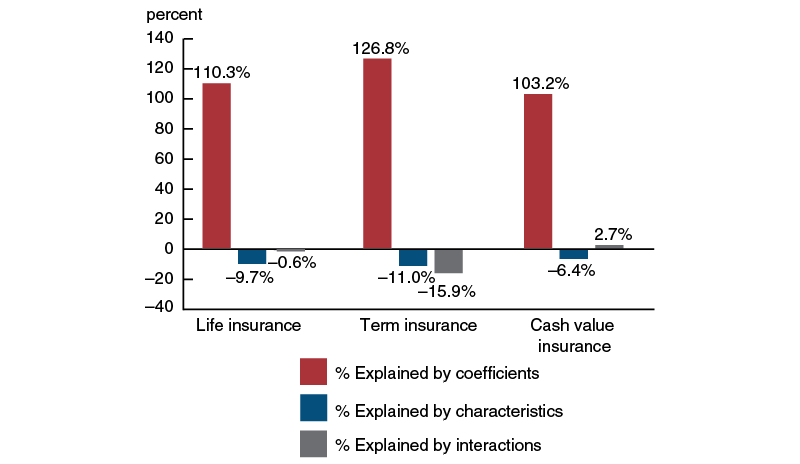

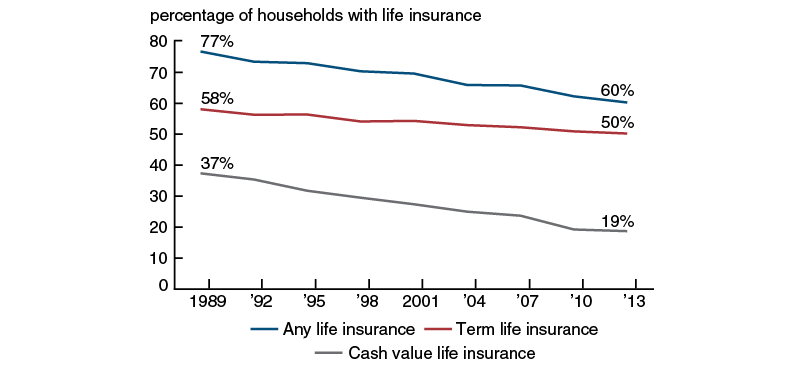

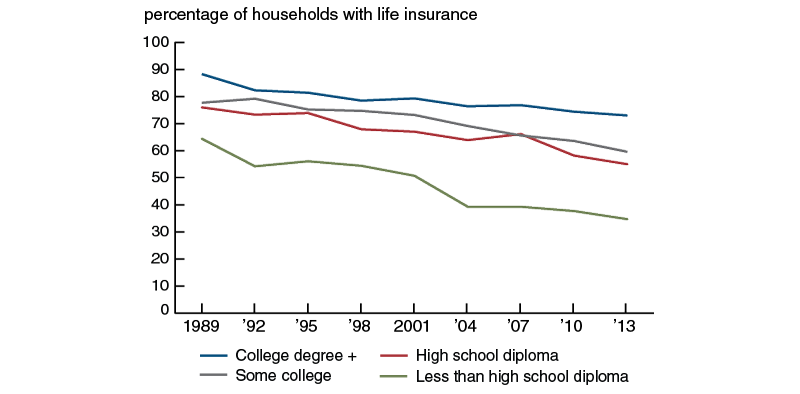

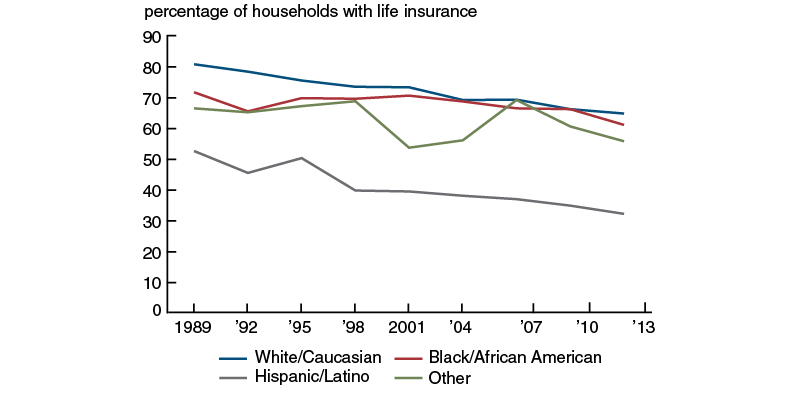

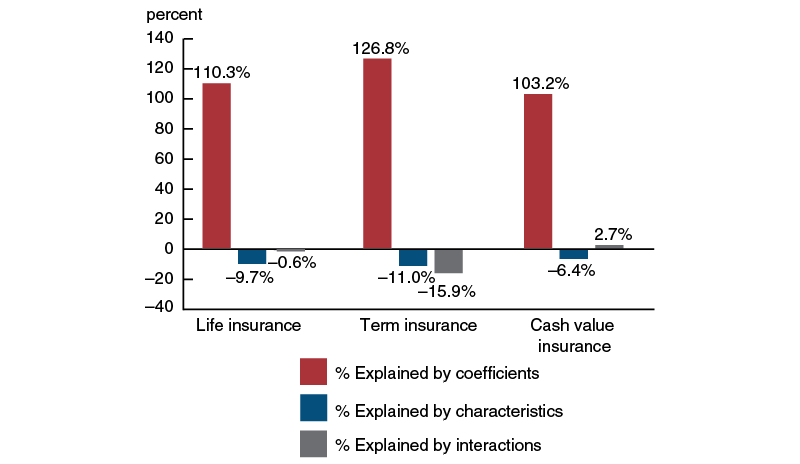

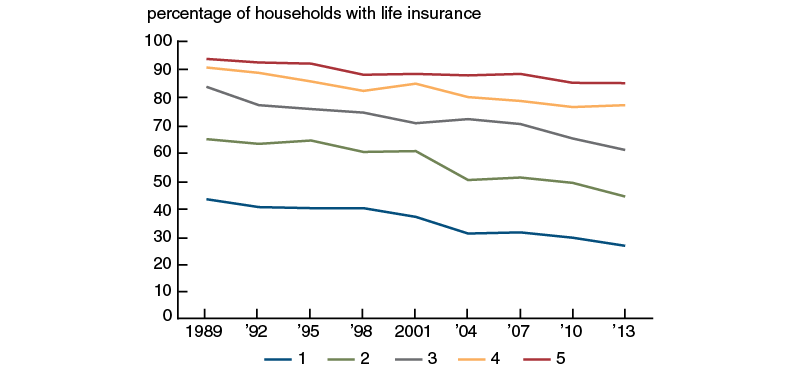

What Explains The Decline In Life Insurance Ownership - Federal Reserve Bank Of Chicago

Implementing Accrual Accounting In The Public Sector In Technical Notes And Manuals Volume 2016 Issue 006 2016

Corporate Owned Life Insurance - Overview - Mullin Barens Sanford Financial And Insurance Services Llc

Corporate Owned Life Insurance - Overview - Mullin Barens Sanford Financial And Insurance Services Llc

What Explains The Decline In Life Insurance Ownership - Federal Reserve Bank Of Chicago

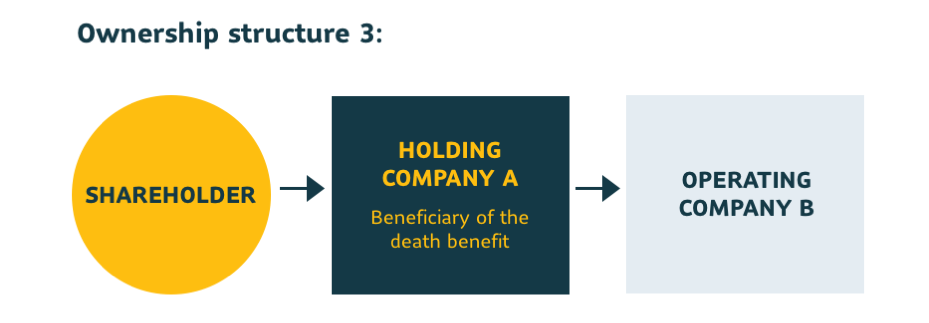

Sun Life Advisor Site - Corporate Ownership Of A Life Insurance Policy

What Explains The Decline In Life Insurance Ownership - Federal Reserve Bank Of Chicago

Do Strict Regulators Increase The Transparency Of Banks - Costello - 2019 - Journal Of Accounting Research - Wiley Online Library

What Explains The Decline In Life Insurance Ownership - Federal Reserve Bank Of Chicago

Bank-owned Life Insurance Boli

What Explains The Decline In Life Insurance Ownership - Federal Reserve Bank Of Chicago

Unwinding An Irrevocable Life Insurance Trust Thats No Longer Needed

Corporate-owned Life Insurance Coli Insurance And Tax Issues - Everycrsreportcom

Wci Obtains Authorised Supervision From Financial Transactions And Reports Analysis Centre Of Canada Fintrac Financial Analysis Accounting And Finance

/hsbc-branch-in-new-bond-street--london-533780165-ff99ebc393c243cba463ea80559836b0.jpg)

Bank-owned Life Insurance Boli

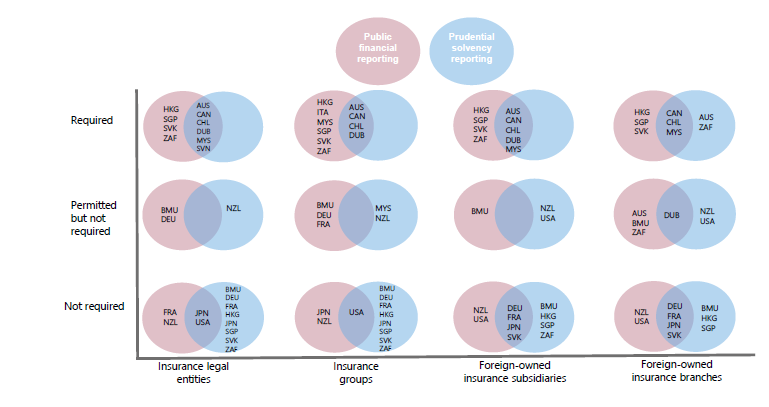

Ifrs 17 Implications For Supervisors And The Industry Access To Insurance Initiative