Life Insurance Face Amount And Death Benefit

The face amount can be changed in some instances, though it’s generally easier to reduce the face amount than to increase it. The death benefit is the actual amount the carrier pays your beneficiaries, and you can tack on additional benefits with riders.

Flowchart Should I Buy Insurance Infographic Infographic Home Insurance Quotes Insurance Sales

The face amount indicates the initial coverage as indicated on the policy.

Life insurance face amount and death benefit. In some forms of life insurance the death benefit is changeable in a number of different ways depending on the type and kind of life coverage chosen. The death benefit is received by the beneficiaries upon any event of disability or death. With some types of life contracts (whole / universal) the face amount can grow a higher death benefit.

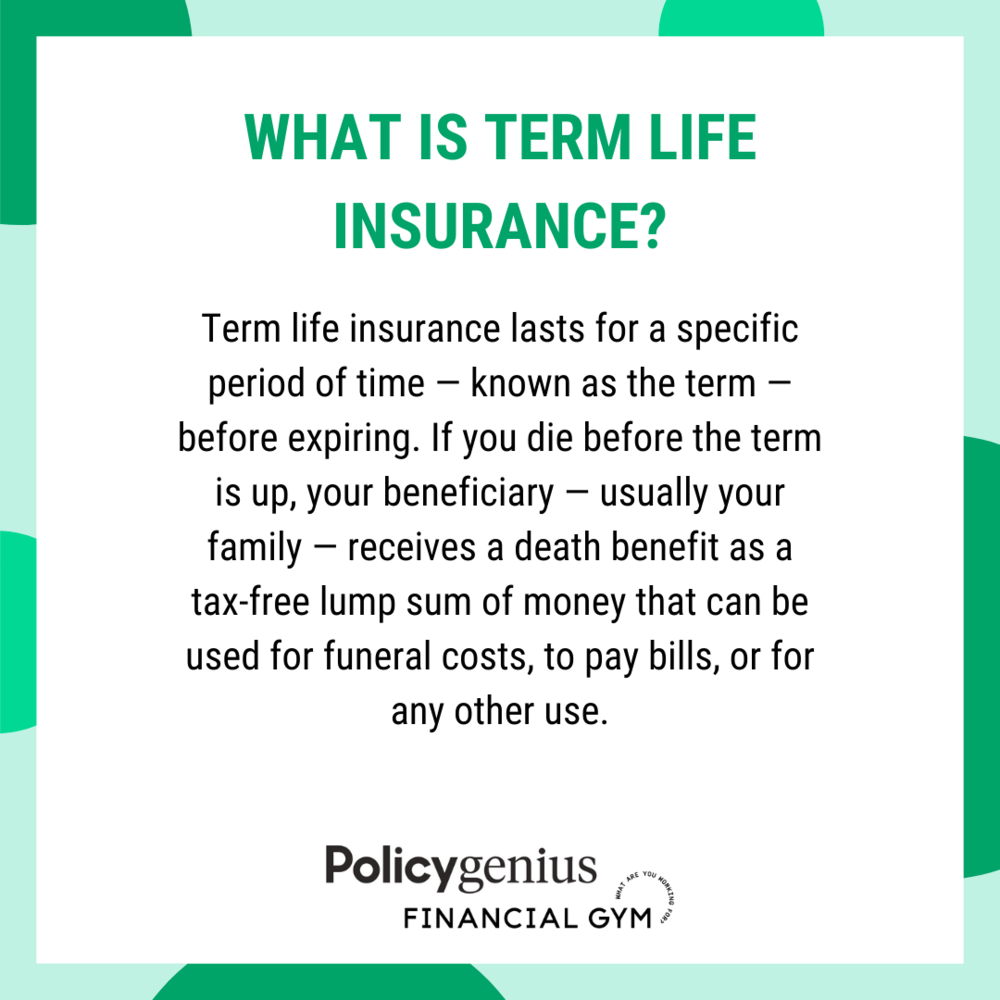

In contrast to the face amount, the death benefit may differ. Worry less about the future with term life insurance. The term death benefit can also be referred to as the db or simply the benefit amount.

Do not assume that the face amount is the same as the death benefit when it comes to permanent life insurance. How & when they differ? However, as time goes by they can.

They both reflect the amount of money that the insurance company will pay out in the case of a valid claim. Incidentally, to say that the death benefit “replaces” the man obviously doesn’t mean in a full literal sense. The face amount of life insurance is the amount on the contract when you buy the policy.

The face value of a life insurance policy is the death benefit, while its cash value is the amount that would be paid if the policyholder opts to. At the beginning of the policy, the face value and the death benefit are the same: It’s not the same as the death benefit.

The face value does not always equal the death benefit, particularly when you are dealing with permanent coverage, such as whole life insurance, that has accompanying riders such as pua riders and term riders and also has life insurance dividends that can increase the. What is the face amount of life insurance? This is often far more easily accomplished with universal life insurance than with whole life insurance.

But only permanent life insurance policies have cash value, which functions similar to a savings or investment account that you can use while you’re still alive. Why death benefits can be so large Ad don’t delay on getting term life insurance.

Simply put, the life insurance face value — also called the death benefit — is the amount that your beneficiary will receive when you die. It refers to the initial coverage amount of a policy. A face amount change differs considerably from a death benefit option change.

If you purchase a policy for $100,000, for example, that amount is the face value of your policy, and that’s the amount that your beneficiaries will receive if you should die while the policy is in effect. In permanent insurance, the death benefit may be higher or lower than the face amount, depending on if the policy had. The reason to the limit the death benefit is to cut down on cost of.

All life insurance policies have a face amount, which is also called the death benefit, this is the amount that’s paid to your beneficiaries after you die. On the contrary, the death benefit is the amount of money that is paid to a beneficiary by an insurance company. The death benefit is the policy’s face value minus any advances you’ve received or benefits paid out for other riders on your policy.

The amount of money that your insurance provider puts toward the policy is known as the face value and is the amount that will be paid out to your beneficiaries when you pass away. Universal life insurance allows policy owners to rather easily make adjustments to the death benefit (or face amount) of their policies. The face amount is stated in the contract or application.

The death benefit is the amount that is actually paid to the beneficiary when death occurs. With term life insurance, the face amount and the death benefit are the same. The term 'face amount' is similar in nature.

Technically speaking with life insurance contracts the person insured does not need to die to. The face amount is the purchased amount at the beginning of life insurance. The face amount almost always equals the death benefit in term insurance.

The face value of a whole life insurance policy. The face amount in life insurance means the amount of insurance you buy. The death benefit can also be defined as the face value or face amount of a life insurance policy.

The face amount of a life insurance policy is frequently the same as its death benefit. How much is a death benefit of a life insurance policy? A death benefit can also be reduced by loans or partial surrenders when the owner takes money out of a policy.

By the same token, if it would take $800,000 to “replace” the economic support the man offers his family, then the life insurance agent will insist the man get a policy with this amount of death benefit coverage. The face amount and the death benefit are the two aspects of life insurance policies. The face amount (death benefit) remains level and cash value continues to earn interest and mature at age 100 single premium the entire premium is paid in a lump sum at the time of purchase and creates immediate cash value

The face amount is the initial amount of money stated on the life insurance application when you first buy the policy and is intended to be paid as a death benefit to your heirs.

Pin On Infographics Life Insurance

Insurance Quotes Critical Illness Life_insurance_montreal Save On Life Insurance With Inde Life Insurance Facts Life Insurance Quotes Life Insurance Marketing

6 Famous Brands Started Or Saved By Life Insurance Frases De Seguros De Vida Seguro De Vida Frases De Seguridad

Pin On Insurance

Pin On Wealthy Living

Pin On Business Value

Common Types Of Life Insurance Infographic Life And Health Insurance Life Insurance Quotes Whole Life Insurance

Twitter Universal Life Insurance Life Insurance Policy Term Life

Senior Life Insurance Various Types And Sample Rates For Each By Age In 2021 Life Insurance For Seniors Term Life Insurance Quotes Life Insurance Quotes

Heart Checkup Medical Care Vector Free Image By Rawpixelcom Chayanit Family Life Insurance Checkup Medical Free Medical

Pin On Insurance

Pin On All About Life Insurance

How Does Whole Life Insurance Work Costs Types Faqs

Life Insurance Infographic Infographicality Life Insurance Facts Life Insurance Quotes Life Insurance Sales

Life Insurance 101

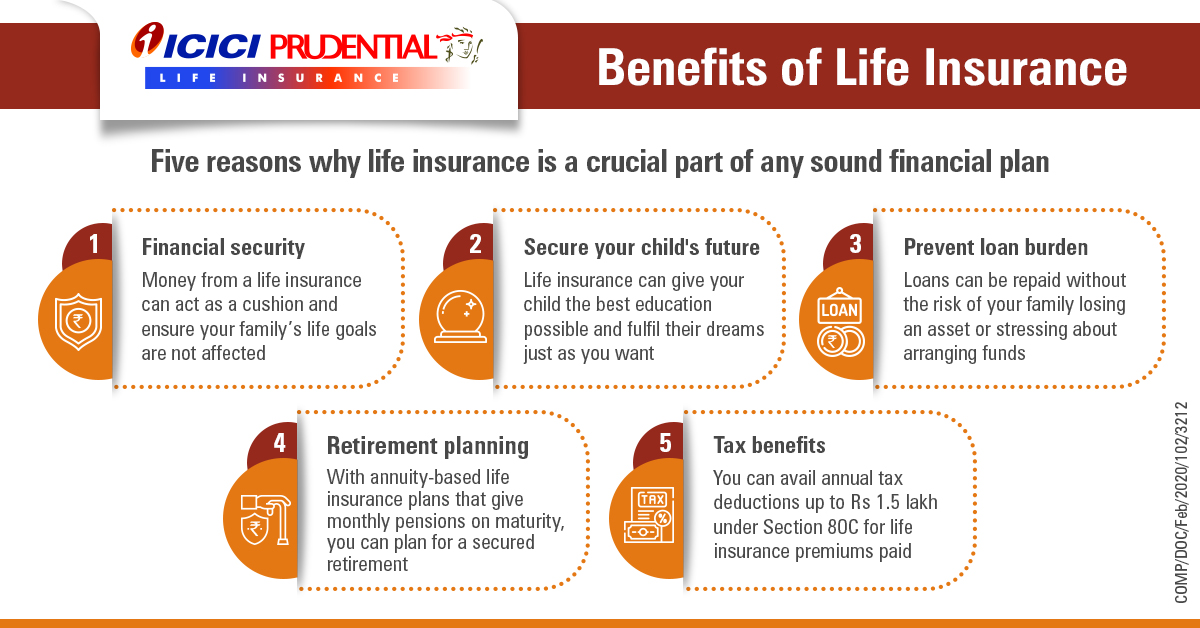

Benefits Of Life Insurance - Need For Life Insurance Icici Prulife

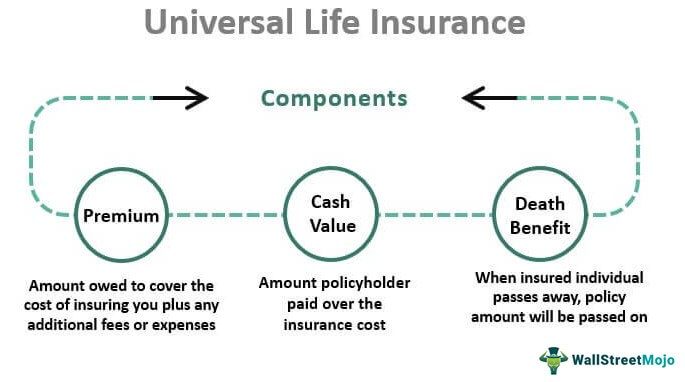

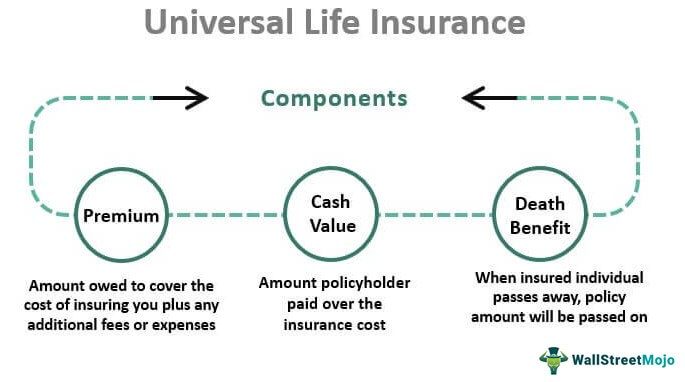

Universal Life Insurance - Definition Explanation Pros Cons

Best Term Insurance Plans In India Buy Cheapest Policy Life Insurance Life Insurance Comparison Life Insurance Policy

Pin On Insurance