Straight Life Annuity At Ard

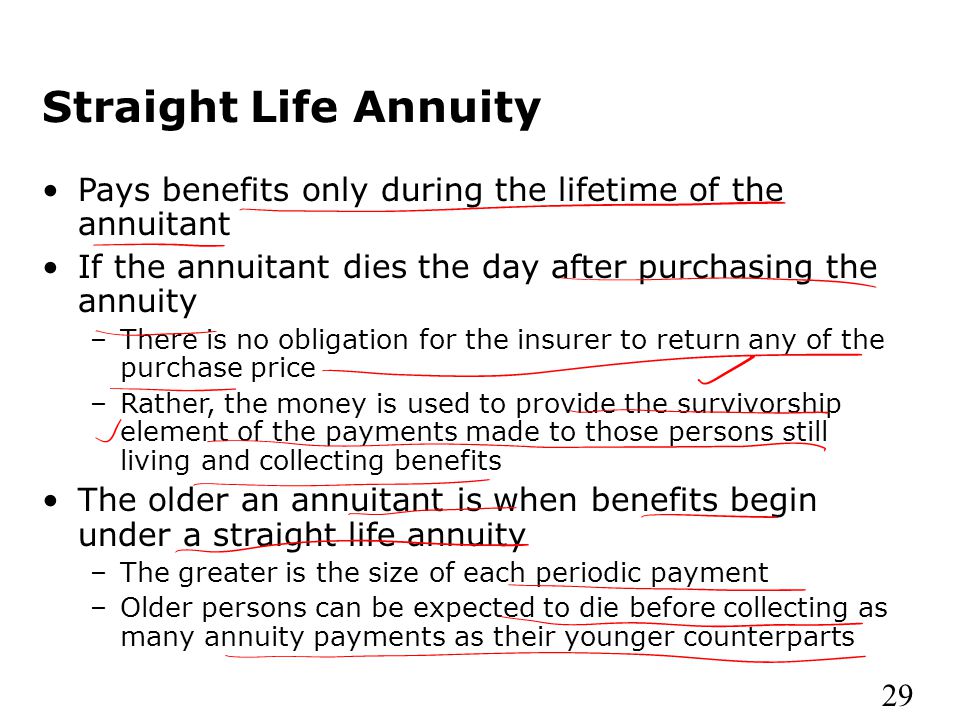

Projected annual benefit means the annual retirement benefit (adjusted to an actuarially equivalent straight life annuity if such benefit is expressed in a form other than a straight life annuity or qualified joint and survivor annuity) to which the participant would be entitled under the terms of the plan assuming (i) the participant will continue employment until normal retirement age under the plan (or. A straight life annuity provides a guaranteed income stream until the death of the annuity owner.

Straight Life Annuity For Retirement Is It Right For You Paradigm Life

A straight life annuity is often used to provide an income stream in retirement.

/stacks-of-coins--a-compass-and-documents-signaling-finances-184104157-eea22b5b70b744318f04c2b6f54a5ef4.jpg)

Straight life annuity at ard. A straight life annuity is a contract between an insurance company and the annuitant. Under a straight life annuity, if the annuitant dies before the principal amount is paid out, the beneficiary will receive. If we look at standard life, the $472.35 is.

Define first variable annuity payment. A straight life annuity is an annuity that pays a guaranteed stream of income but ceases payments upon the death of the annuity holder. If the nyse is not open on that date, the calculation will be.

What is a straight life annuity. The dollar amount of the first variable annuity payment is the sum of the payments from each portfolio determined by applying the contract value used to purchase variable annuity payments, as of the 15th day of the preceding month, to the variable annuity purchase rate table of this contract. The reduction is based on the age of the retiree and spouse.

The amount of the payments is determined by the amount of the purchase payment and the annuitant’s age at the time the payments begin. A straight life annuity is an insurance contract that pays out a series of fixed payments over the life of the owner, or annuitant. If you die within 5, 10 or 15 years after the date your benefits are first payable (the actual retirement date (ard) you choose on your benefit application in item 1), your designated beneficiary will receive the benefit for the remainder of that “certain” period.

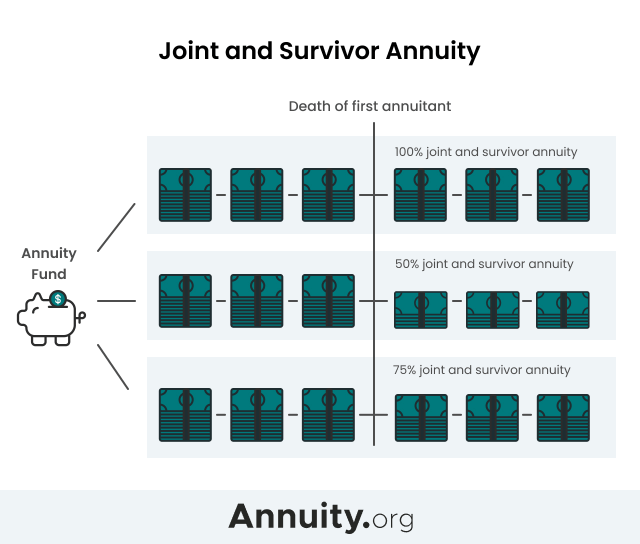

Over their two lifespans, the benefit is. A straight life annuity is a type of annuity in which the annuitant receives payments for as long as they live. No survivor benefit will be paid after your death.

When used tactically as part of an overall retirement strategy, life annuities provide both financial stability and a permanent hedge against longevity risk. “survivor” annuity) to the spouse upon the death of the retiree. A straight life retirement annuity means that the retiree will receive a monthly annuity payment for as long as she lives, and then the payments stop.

Annuities are one way to make your money work for you and provide a reliable income stream in retirement. Based on the scenario given above, the transaction that will likely be provided to t at the age of seventy is that the income that he will receive won't be likely outlived by the owner. This post deals with the estate taxation of annuities.

Straight life annuities do not include a death benefit, so payments can’t be made to a beneficiary. No survivor benefit will be paid upon your death. You can choose any inflation figure you want but the higher the inflation rate, the more the income is going to drop.

If the annuitant dies before the entire proceeds are paid out, the remainder of the. A life annuity is, at heart, a pension you purchase for yourself. Now, will a straight life annuity be right for you?

The annuitant usually purchases the annuity with a lump sum deposit, and the insurer promises to make a fixed regular payment to the annuitant for life. The straight life income annuity option pays the annuitant a guaranteed income for his or her lifetime. Who knows, it could be.

A straight life annuity, sometimes called a straight life policy, is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or a death benefit. It is because the straight life annuity in which the periodic payment to the annuitant will only be until his or her death. Here’s the results for a life annuity indexed at 2% for the same 65 year old male:

Other forms of annuity pay you only for a certain amount time. Because the payouts will be shorter in. If the abovementioned applies to you, you could purchase straight life annuity and experience lower premiums and higher payouts, especially compared with other types of retirement insurance products.

With no payouts after the owner's death, this means that heirs, beneficiaries, and. The form of life annuity which pays benefits throughout the lifetime of the annuitant and also guarantees payment for a minimum number of years is called. With a straight life annuity, you pay a certain amount of money and then receive regular payments until you die.

A straight life policy, which is sometimes referred to as a straight life annuity, is a type of plan that’s designed to provide a regular income to the annuitant as long as they live. Once the annuitant dies, all payments stop and the policy terminates. Internal revenue code §2039 deals with traditional annuity contracts as well as other types of contractual arrangements under which a decedent was entitled to receive a periodic payment.

For example, if your basis in the annuity is $30,000 and you'll be receiving 60 payments, then you divide $30,000 by 60 for a. Internal revenue code §72 governs the income taxation of annuity contracts. After sam dies, carol does not receive any benefits.

Joint And Survivor Annuity The Benefits And Disadvantages

Agnes Cheng 1994 Pdf Internal Rate Of Return Capital Budgeting

Pdf Chapter 6 The Role Of Collective Pension Schemes And How These Could Be Introduced In The Uk Report Of The Independent Review Of Retirement Income

Pdf A General Procedure For Constructing Mortality Models

Apfaorg

Jstororg

Annuities And Individual Retirement Accounts - Ppt Video Online Download

Straight Life Annuities Simplified Guide Trusted Choice

Summary Ross Ch 7 8 I Bonds And Bond Valuation 1 A Few Terms Used When - Studocu

/stacks-of-coins--a-compass-and-documents-signaling-finances-184104157-eea22b5b70b744318f04c2b6f54a5ef4.jpg)

Straight Life Annuity Definition

![]()

Life Contingencies - Um Dos Melhores Livros De Atuaria Escrito Por Chester Wallace - Docsity

Straight Life Annuity 2021 The Annuity Expert

Life Contingencies - Um Dos Melhores Livros De Atuaria Escrito Por Chester Wallace - Docsity

Straight Life Annuity Definition

What Is A Straight Life Annuity Retirement Watch

Panincoid

Straight Life Annuity For Retirement Is It Right For You Paradigm Life

Straight Life Annuity For Retirement Is It Right For You Paradigm Life

Pdf Should We Revive Payg On The Optimal Pension System In View Of Current Economic Trends Should We Revive Payg On The Optimal Pension System In View Of Current Economic Trends