Private Placement Life Insurance Disadvantages

A hedge fund is like a mutual fund, only with a more aggressive investment strategy and higher risk. If ppli is owned by an irrevocable trust, policy proceeds will be free not only of income tax, but also free from estate tax.

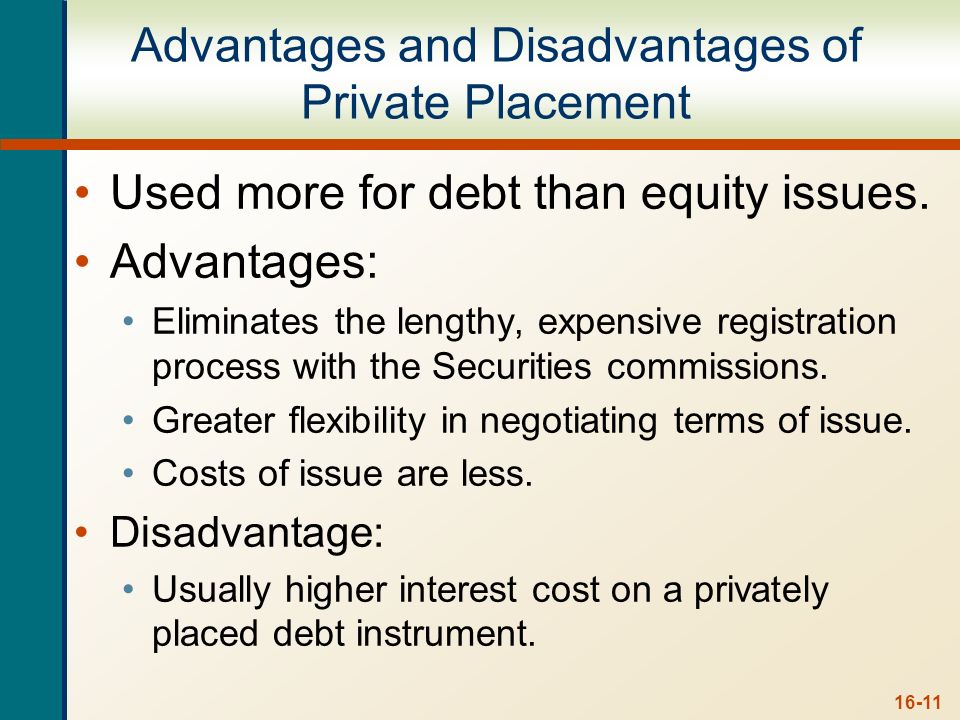

Key Concepts And Skills - Ppt Video Online Download

Private placement life insurance is a very powerful solution for the right wealthy clients in the right circumstances.

Private placement life insurance disadvantages. More than the death benefits and tax savings, private placement life insurance allows for more fluidity. However, in an annuity policy, someone will pay the tax. Private placement life insurance (ppli) is institutionally priced life insurance designed for wealthy investors who want to avoid the taxes of hedge funds.

The lack of a death benefit (and certain other differences in potential taxation on premiums paid) also typically result in a ppva being less expensive than ppli. As part of a life insurance policy, assets may grow tax deferred during the insured’s lifetime. This article will not address private placement annuity products.

These investors tend to be more patient and have lower expectations than venture capitalists, giving companies a longer time frame for providing a. Private placement life insurance disadvantages. All universal life insurance policies, private or public, offer important tax benefits for the policyholder, including:

What are the disadvantages of private placement life insurance? Pplis are variable, universal life insurance policies, but are also unregistered securities products. You can access assets, if you wish, through

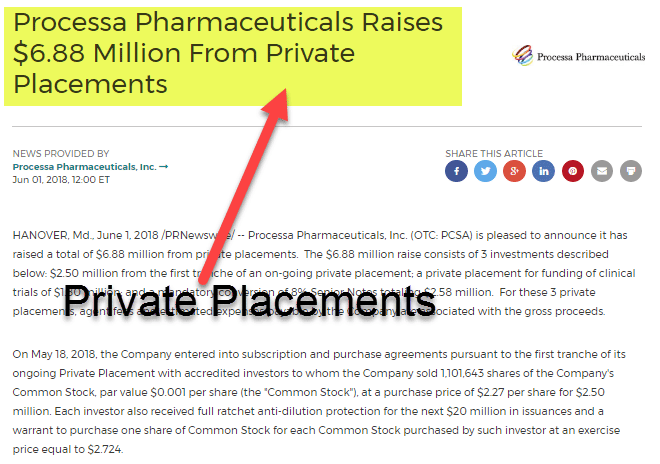

In reality, the typical ppli candidate or family has: A ppli policy is sophisticated and complex. Private placements offer a high degree of flexibility in terms of how much money can be raised, from as little as $100,000 to tens of millions of dollars.

The policyholder has to pay for insurance death benefit irrespective of whether there is a need for insurance. A desire for hedge fund or alternative investment exposure. 7 significant benefits of ppli investments.

Commonly overlooked is the fact that the purchase of private placement products should be an investment decision, first and foremost. The idea behind ppli is to combine the financial advantages of hedge funds with the tax benefits of life insurance. For some taxpayers, however, private placement life insurance (ppli) may hold another solution.

The key disadvantage with this approach is that it is typically more expensive for a carrier to offer a customized policy to a client. Similar to variable life insurance policies issued by many life insurance companies, pplis enable you to participate in investments structured to replicate hedge funds and other alternatives that can build your policy’s cash value over time. Private placement investment options • registered variable life products (vul) can only invest in registered subaccounts must have daily valuation must offer daily liquidity • private placement products can be invested in subaccounts that are unregistered can be valued on a monthly or quarterly basis

Usually, clients buy private placement life insurance more as an investment vehicle than because they actually want life insurance. It has many advantages, but it also has limitations. The annuity policies are quicker to set up, easier to set up, have lower minimums, they have the same investment options you would have in a private placement life insurance policy, and the charges are often lower.

The ability to fund $1 million or more in annual premiums for several years, at least — $3 million to $5 million is typical. The current shareholders will have their interest diluted in the company because of the private placement. On october 9, 2020 by.

Whereas term life insurance offers only a death benefit that diminishes over the years, a permanent life insurance policy offers a guaranteed death benefit and builds cash value over time. Policyholders exchange tax friction for the additional expense imposed by. Due to its nature, private placement life insurance is only offered to qualified purchasers seeking to invest large sums of money (often more than us$1 million) in the policy.

How Does Private Placement Life Insurance Work - Valuepenguin

Variable And Universal Life Insurance

Private Placement Life Insurance Ppli A Tax-efficient Choice For Wealthy People To Invest In Alternates

The Ultimate Guide To Private Placement Life Insurance Worthune

Private Placement Life Insurance Life Insurance And Deferred Variable Annuities Setting Upbenefits And Advantages-taxindiainternationalcom

Effective Ppli Real Estate Structures-2 - Blog - Michael Malloy Solutions

Private Placement Life Insurance Life Insurance And Deferred Variable Annuities Setting Upbenefits And Advantages-taxindiainternationalcom

Private Placement Of Shares Top Advantages Disadvantages

Top 10 Pros And Cons Of Variable Universal Life Insurance

![]()

What Are The Advantages Of Private Placement

Private Placements And Venture Capital Chapter 28 Tools Techniques Of Investment Planning Copyright 2007 The National Underwriter Company1 What Is It - Ppt Download

2

The Ultimate Guide To Private Placement Life Insurance Worthune

Top 10 Pros And Cons Of Variable Universal Life Insurance

Benefits Of Private Placement Life Insurance

:max_bytes(150000):strip_icc()/dotdash_Final_Private_Equity_Apr_2020-01-3ce99c81ce344ddc94fe05b17a2b7716.jpg)

Private Equity Definition How Does It Work

The Ultimate Guide To Private Placement Life Insurance Worthune

Private Placement Life Insurance Life Insurance And Deferred Variable Annuities Setting Upbenefits And Advantages-taxindiainternationalcom

![]()

Benefits Of Private Placement Life Insurance